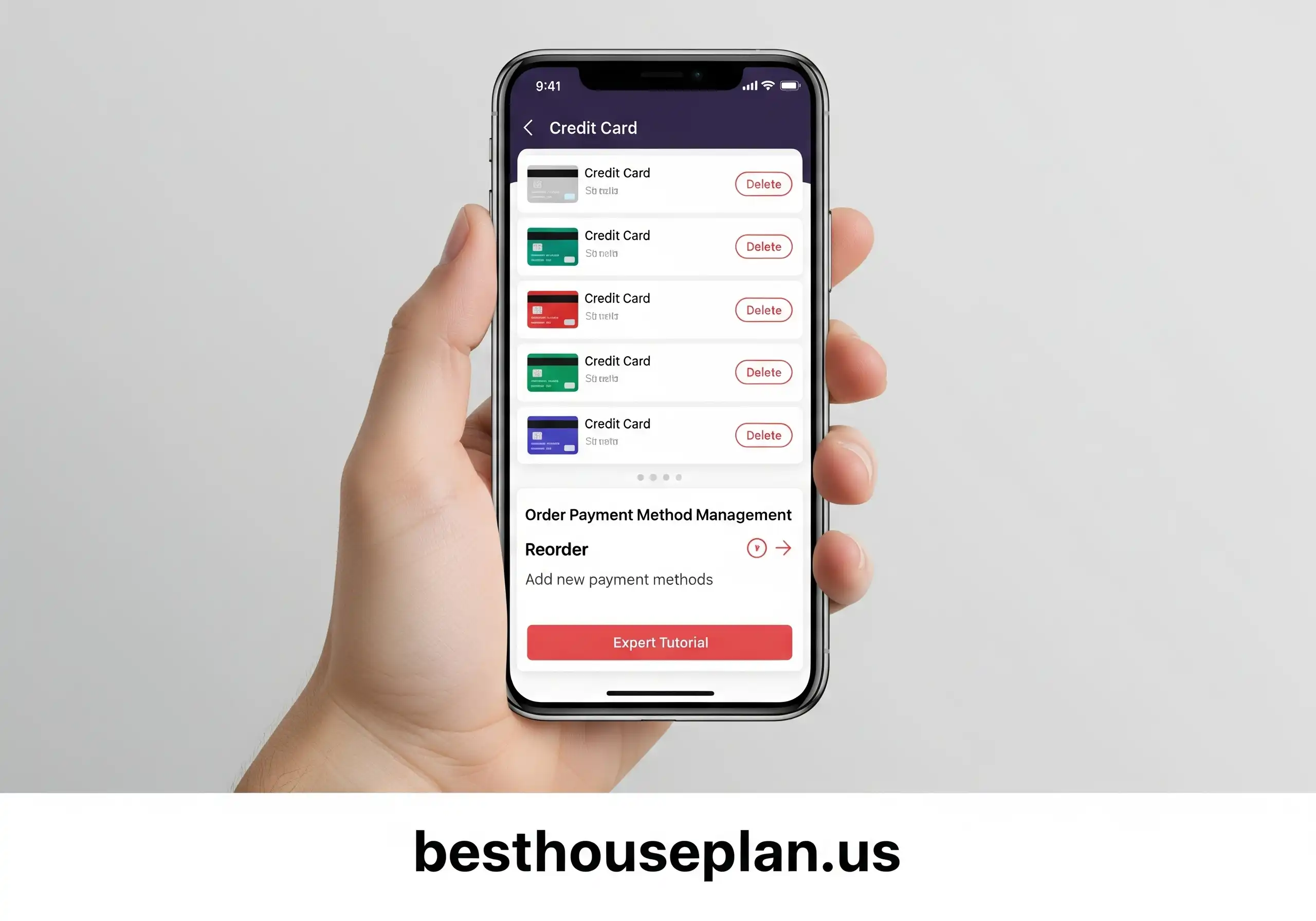

Saved Credit Cards iPhone View Delete Order Payment Method Management Expert Tutorial invites you to unlock the full potential of your iPhone’s payment capabilities. In today’s fast-paced world, the convenience of saved credit cards brings speed and efficiency to transactions, making your shopping experience smoother than ever. With robust security measures in place, managing your payment methods has never been safer or more straightforward.

This guide covers everything from viewing and deleting saved credit cards to enhancing your overall payment method management. You’ll discover easy step-by-step instructions, best practices for security, and tips for a seamless checkout experience that integrates loyalty programs and emerging technologies.

Overview of Saved Credit Cards Management on iPhone

Managing saved credit cards on your iPhone brings convenience and speed to your payment processes, streamlining your shopping experience whether online or in-store. By securely storing your credit card information, you can make purchases with just a few taps, eliminating the need to enter details every time you transact. This feature not only enhances accessibility but also fosters a quicker checkout process, making it an essential tool for today’s fast-paced lifestyle.The iPhone supports a variety of payment methods for saved cards, encompassing multiple credit and debit card networks.

Users can easily add their cards through the Wallet app, which allows for seamless integration into various payment platforms, including Apple Pay. This functionality promotes ease of use across various merchants, both physical and digital.

Experience premium connectivity with the Verizon Motorola Edge Plus Order Premium Carrier Compatible Network Tech Certified. This state-of-the-art smartphone is designed to work seamlessly with Verizon’s network, offering you top-notch performance and reliability wherever you are!

Types of Payment Methods Supported

The iPhone accommodates an extensive range of payment methods for saved credit cards. This diverse support ensures that users have flexibility in how they choose to pay. The following payment methods are commonly supported:

- Credit Cards: Major card networks like Visa, MasterCard, American Express, and Discover.

- Debit Cards: Bank-issued debit cards that are linked directly to a user’s checking account.

- Prepaid Cards: These cards can be loaded with a specific amount of money and used like standard credit or debit cards.

- Store Cards: Retail-specific credit cards that can be stored and used for purchases at designated stores.

- Digital Wallets: Integration with services such as PayPal and Venmo that allow for alternative payment methods.

Security Measures for Managing Saved Card Information

The security of saved card information is paramount, especially given the increasing prevalence of online fraud. Apple has implemented robust security measures to protect your financial data. These measures include:

- Encryption: Card details are encrypted on the device and during transmission, ensuring they are not accessible to unauthorized users.

- Two-Factor Authentication: Users can enhance security by enabling two-factor authentication, adding an extra layer of protection against unauthorized access.

- Face ID and Touch ID: Transactions can be authenticated using biometric features, ensuring that only the authorized user can complete a purchase.

- Secure Element: A dedicated chip within the iPhone securely stores payment information, making it more challenging for malicious software to access it.

- Transaction Alerts: Users receive real-time notifications of transactions made, which helps in monitoring for any suspicious activity.

“Apple prioritizes user security, employing industry-leading technology to safeguard payment information.”

How to View Saved Credit Cards on iPhone: Saved Credit Cards IPhone View Delete Order Payment Method Management Expert Tutorial

Viewing your saved credit cards on your iPhone is a straightforward process, making online shopping and payment processing quick and effortless. Keeping track of your payment methods is crucial for managing your finances and ensuring security while shopping. This guide will walk you through the steps to easily access your saved credit card information.

Accessing Saved Credit Card Information Through the Wallet App, Saved Credit Cards iPhone View Delete Order Payment Method Management Expert Tutorial

To view your saved credit cards in the Wallet app, follow these simple steps:

- Open the Wallet app on your iPhone. The Wallet app is typically found on your home screen or in the utilities folder.

- Once the app is open, you will see a list of your stored cards. Tap on the card you wish to view.

- The card will display your credit card number, expiration date, and card type. To see more details, tap on the small (i) information icon located at the bottom right of the card.

- For security reasons, the full card number is not displayed. However, you can access your card number by tapping on the card image, which will reveal an option to show the number.

Alternative Methods of Viewing Saved Cards in Safari and Other Apps

In addition to the Wallet app, you can view your saved credit cards during checkout in various applications, such as Safari or third-party shopping apps. Here’s how:

- When making a purchase in Safari, simply tap on the payment option. Your saved credit cards will automatically populate, allowing you to choose the card you wish to use.

- In supported apps, during the payment process, tap on “Credit/Debit Card” and the app will present your saved cards for selection.

Troubleshooting Tips for Users Unable to View Their Saved Cards

If you encounter issues viewing your saved credit cards, consider the following troubleshooting tips to resolve the problem:

- Ensure that your iPhone is updated to the latest iOS version, as software updates can fix bugs and improve app performance.

- Check if your Wallet app is enabled in your device settings. Go to Settings > Wallet & Apple Pay and ensure the options are turned on.

- Restart your iPhone. This can clear temporary glitches affecting app performance.

- Confirm that your cards are correctly saved in the Wallet app, as they may have been removed or not properly added.

- If using Safari, ensure that you have autofill enabled in your browser settings. Navigate to Settings > Safari > Autofill and verify your credit card information is saved.

“For a seamless shopping experience, always keep your saved cards updated in your Wallet app.”

How to Delete Saved Credit Cards on iPhone

Managing your saved credit cards on your iPhone is essential for maintaining both organization and security. Over time, you may accumulate several cards that are no longer in use or that you wish to remove for safety reasons. This section will guide you through the process of deleting credit cards from the Wallet app as well as from your web browsers, ensuring your information remains secure and up-to-date.

Deleting Credit Cards from the Wallet App

To delete a saved credit card from the Wallet app on your iPhone, follow these simple steps:

- Open the Wallet app on your iPhone.

- Locate the card you want to delete. If you have many cards, scroll through or use the search feature.

- Tap on the card to open its details.

- In the corner, tap the ellipsis icon (three dots) for more options.

- Scroll down and select Remove Card.

- Confirm your choice by tapping Remove to delete the card permanently.

This process ensures that any outdated or unused cards are removed from your Wallet, keeping your financial information secure.

Removing Saved Cards from Safari

In addition to removing cards from the Wallet app, it’s also crucial to delete any saved credit card information from web browsers like Safari. This is particularly important for maintaining privacy and security during online transactions. The steps to remove saved cards in Safari are as follows:

- Open Settings on your iPhone.

- Scroll down and tap on Safari.

- Locate and select AutoFill.

- Tap on Saved Credit Cards. This requires authentication via Face ID or Touch ID.

- Find the card you wish to delete and tap on it.

- At the bottom of the screen, tap Remove Card to delete it.

By following these steps, you can ensure that your web browsing experience remains secure, and any outdated payment methods are no longer accessible.

Enhance your workout routine with our premium Phone Armband Running Exercise Fitness Order Workout Holder Tech Expert Quality. Designed for maximum comfort and durability, this armband keeps your phone secure while you focus on your fitness goals. Get moving with confidence!

Best Practices for Managing Saved Cards

To maintain optimal organization and security with your saved credit cards, consider the following best practices:

- Regularly review and delete any old or unused cards to prevent unauthorized access.

- Ensure your iPhone is updated to the latest iOS version, as updates often include security enhancements.

- Utilize strong authentication methods such as Face ID or Touch ID when managing your saved cards.

- Be cautious when using public Wi-Fi networks, as they can pose risks to sensitive information.

“Keeping your saved card information secure is as important as the transactions themselves.”

By implementing these best practices, you can enjoy the convenience of saved cards while minimizing the risk of data breaches or unwanted transactions.

Discover the perfect blend of affordability and performance with the T Mobile Samsung Galaxy A14 Purchase Ultra Budget Carrier Compatible Network. Get ready to enjoy ultra-budget pricing while staying connected on a reliable network. It’s the smart choice for savvy shoppers!

Managing Payment Methods on iPhone

Managing payment methods on your iPhone is essential for seamless transactions and maintaining financial security. With the Wallet app, you can easily add new payment methods, set default options, and keep your information updated. This ensures a smooth checkout experience and helps you stay organized with your finances.

Adding a New Payment Method in the Wallet App

To add a new payment method to your Wallet app, follow these simple steps to enhance your shopping experience. Ensure your iPhone is running the latest version of iOS for optimal functionality.

Upgrade your mobile experience with the iPhone 15 No Credit Check Previous Model Order Budget Financing Payment Expert Approved. Now you can own the latest model without the worry of credit checks! Our budget-friendly financing options make it easier than ever to get your hands on the technology you love.

- Open the Wallet app on your iPhone.

- Tap on the “+” (Add) button in the top right corner.

- Select “Credit or Debit Card” from the options presented.

- Choose to either scan your card using your camera or enter the card details manually.

- Follow the prompts to verify your card with your bank, which may include a verification code sent via SMS or email.

- Once verified, your new payment method will be added to your Wallet.

Adding payment methods this way ensures you can make quick and secure purchases directly from your device.

Setting a Default Payment Method

Choosing a default payment method simplifies your checkout process. Setting one ensures that your preferred payment method is always selected automatically during transactions. Here’s how to do it:

- Open the Settings app on your iPhone.

- Scroll down and tap on “Wallet & Apple Pay.”

- Under the “Payment Cards” section, you will see a list of your saved cards.

- Tap on the card you wish to set as your default.

- Tap on “Default Card” to select it.

By selecting your default payment method, you streamline the purchasing process, allowing for faster payments at stores and online.

Importance of Regularly Reviewing and Updating Payment Methods

Maintaining accurate and up-to-date payment methods is crucial for various reasons, particularly in today’s digital landscape. Regularly reviewing your saved payment methods helps ensure that you are protected against unauthorized transactions and that your payments are processed without issues. Consider the following points for effective management:

- Security: Regular reviews help identify outdated or compromised payment methods that should be removed.

- Convenience: Keeping your payment information current ensures smooth transactions, especially during online shopping or using Apple Pay.

- Financial Control: Monitoring saved payment methods allows you to track spending patterns effectively and manage your budget.

By keeping your payment methods updated, you can enhance your financial management and maintain a secure environment for your transactions.

“Regularly auditing your payment methods is as essential as managing your monthly budget.”

Troubleshooting Common Issues with Saved Credit Cards

Managing saved credit cards on your iPhone should be a seamless experience, but sometimes users encounter issues that can disrupt their payment processes. Understanding these common challenges and knowing how to resolve them can help enhance your overall experience with mobile payments.One frequent problem users face involves failed payment transactions, often attributed to errors with the saved card details. These errors can stem from expired cards, incorrect information, or compatibility issues with specific merchants.

It’s essential to be aware of these challenges and how to address them effectively.

Embrace the future of mobile technology with the Straight Talk Samsung Galaxy Z Flip 4 Purchase Foldable Prepaid Carrier Compatible. This innovative foldable phone combines cutting-edge design with functionality, perfect for the modern user looking for a prepaid option without compromising quality.

Common Challenges with Saved Credit Cards

Several obstacles can arise when managing saved credit cards. Recognizing these can lead to quicker resolutions. Here are some key issues users might encounter:

- Expired Cards: Payments may fail if the card’s expiration date has passed. Always ensure that your saved cards are current.

- Incorrect Card Information: A small typo in the card number or CVV can lead to payment failures. Double-check all saved details.

- Insufficient Funds: If the card is linked to a checking account, ensure there are enough funds available for the transaction.

- Merchant Compatibility: Some merchants may not accept certain types of cards. Verify if your card is accepted before attempting to make a purchase.

- Software Updates: Outdated iOS versions can cause issues with saved card functionalities. Keeping your device updated is crucial.

Solutions for Failed Payments

When payments fail due to card errors, there are several steps users can take to resolve the issues. These solutions can help restore the functionality of saved cards:

- Update Card Information: Navigate to the Wallet app and verify that all details for your saved card are accurate and up-to-date.

- Check Expiration Dates: Remove any expired cards and replace them with current information to avoid payment failures.

- Contact Your Bank: If you suspect issues with your card, reach out to your bank or card issuer for clarification and assistance.

- Attempt a Different Payment Method: If problems persist, consider using a different card or payment method temporarily.

Troubleshooting Checklist for Users

For users experiencing difficulties with saved credit cards, a comprehensive troubleshooting checklist can be invaluable. This checklist will help ensure all potential issues are addressed systematically.

Charge multiple devices with speed and efficiency using our Wall Charger Phone Dual Port Fast Purchase Multi Device Tech Expert Certified. This powerful charger is perfect for those who need to stay connected on the go. Experience the convenience of fast charging for all your devices!

“Identifying and resolving issues promptly can save time and effort, ensuring a smooth transaction experience.”

- Verify current card expiration date and update as necessary.

- Check for accuracy in card details, including the card number and CVV.

- Ensure sufficient funds are available in the linked account.

- Confirm that the merchant accepts your type of card before placing an order.

- Update the iOS software on your iPhone to the latest version.

- Restart the Wallet app or your device to refresh the system.

- Contact customer support if issues persist after attempting the above solutions.

Maintaining your saved credit cards effectively can enhance your shopping experience on your iPhone, allowing for quick and reliable transactions, minimizing disruptions caused by common payment issues.

Best Practices for Secure Payment Method Management

Managing saved credit cards on your iPhone can offer convenience, but it also requires a commitment to security. As digital transactions become increasingly prevalent, it is essential to adopt best practices to safeguard your financial information. Employing robust security measures not only protects your payment methods but also fosters peace of mind in your online interactions.

Importance of Strong Passcodes and Biometric Authentication

Utilizing strong passcodes and biometric authentication is a crucial step in enhancing the security of your saved payment methods. A strong passcode consists of a mix of letters, numbers, and special characters, making it difficult for unauthorized users to gain access. Biometric authentication, such as Face ID or Touch ID, adds an additional layer of security by requiring a unique biological characteristic for access.

“Employing both a strong passcode and biometric authentication significantly reduces the risk of unauthorized access to your payment information.”

Unlock the potential of owning the latest technology with our iPhone Without Credit Check Rent To Own Purchase Easy Approval Payment Plan Available. Enjoy hassle-free approval and flexible payment options that suit your budget. Experience seamless connectivity and cutting-edge features without the stress of credit checks!

When these methods are combined, they create a formidable barrier against potential threats, ensuring that your saved credit card information remains protected.

Recognizing Phishing Attempts Related to Saved Credit Cards

Phishing attempts are a common threat that can jeopardize your saved credit card information. These attempts typically occur via emails, text messages, or even phone calls, where scammers impersonate legitimate institutions to trick you into divulging personal information. To protect yourself:

- Always verify the sender’s email address or phone number before clicking on links or providing any information.

- Look for signs of urgency or threats in the message, as these are common tactics used by scammers.

- Avoid clicking on links in unsolicited messages; instead, visit the official website directly to log in to your accounts.

“Being cautious and informed is your best defense against phishing scams that target your financial information.”

Recommended Security Apps for Additional Protection

In addition to strong passwords and phishing awareness, utilizing security apps can further bolster your payment method management. Here is a list of recommended security applications that provide enhanced protection for your financial data:

LastPass

A password manager that securely stores your passwords and generates strong ones.

1Password

Offers secure storage for sensitive information, including credit card details, with robust encryption.

Norton Mobile Security

Provides comprehensive protection against malware and phishing attacks.

McAfee Mobile Security

Features an app lock and anti-theft capabilities to secure your device and data.

Bitdefender Mobile Security

Protects against online threats with advanced security features and privacy protection.These applications not only safeguard your saved credit card information but also enhance your overall digital security posture. Prioritizing your payment method management with these best practices ensures a safe online shopping experience.

Enhancing User Experience with Payment Methods

Optimizing payment methods on your iPhone can significantly enhance your shopping experience. With the right settings and integrations, you can enjoy faster checkouts, better management of loyalty programs, and a more secure way to manage your finances. This section dives into essential tips and features that can help you get the most out of your payment methods on iOS.

Optimizing Payment Method Settings

Streamlining your payment method settings is key to ensuring quick and efficient transactions. By setting up your iPhone to remember preferred payment options and using features like Apple Pay, you can minimize friction during the checkout process. Consider the following strategies to enhance your payment experience:

- Enable Apple Pay: Set up Apple Pay to make contactless payments at participating retailers, allowing for quicker checkouts.

- Use Default Payment Options: Designate specific cards for particular apps or services to avoid selecting options each time you make a purchase.

- Autofill Payment Information: Utilize the autofill feature in Safari to automatically fill in your payment details when shopping online.

- Regularly Update Cards: Keep your payment information up to date to prevent any interruptions during transactions.

Integrating Loyalty and Rewards Programs

Synchronizing your saved credit cards with loyalty and rewards programs can maximize benefits and improve your shopping incentives. Many retailers offer points, discounts, or cash back when using specific payment methods. Here’s how you can leverage these programs:

- Link Loyalty Accounts: Connect loyalty programs directly to your payment methods for automatic point accumulation with every purchase.

- Track Rewards Effortlessly: Use apps to monitor rewards points, status, and eligible purchases associated with your saved cards.

- Exclusive Offers: Take advantage of special promotions that are linked to your payment methods, providing additional savings or benefits.

- Combine Offers: Use your loyalty program benefits alongside credit card rewards to maximize savings on larger purchases.

Comparison of Payment Method Options on iPhone

Understanding the various payment method options available on your iPhone can help you choose the best fit for your needs. Below is a comparison chart that highlights key features of different payment methods available to iPhone users:

| Payment Method | Availability | Transaction Speed | Rewards Program Integration | Security Features |

|---|---|---|---|---|

| Apple Pay | Widely supported in stores and apps | Instantaneous | Compatible with many loyalty programs | Face ID, Touch ID, Device-specific number |

| Credit/Debit Cards | All merchants accepting cards | Varies by merchant | Dependent on card issuer | EMV chip technology, CVV protection |

| PayPal | Online and select in-store | Fast for online transactions | Limited integration options | Two-factor authentication |

| Store-specific Apps | Only at specific retailers | Fast, typically seamless | Often exclusive offers | App-specific security |

Future of Payment Methods on Mobile Devices

As we venture into an increasingly digital landscape, the future of payment methods on mobile devices presents exciting possibilities. Innovations in technology and changing user behavior are reshaping how we manage our financial transactions. With the rise of artificial intelligence, blockchain, and enhanced security measures, the mobile payment ecosystem is poised for a transformation that prioritizes convenience and security.

Emerging Technologies Influencing Saved Credit Card Management

The integration of emerging technologies is revolutionizing saved credit card management on mobile devices. Key advancements include:

- Blockchain Technology: This decentralized ledger system enhances transparency and security in transactions. By utilizing blockchain, users can store payment information with increased protection against fraud.

- Artificial Intelligence: AI-driven algorithms are being deployed to analyze spending patterns and detect anomalies, offering real-time alerts and improved security measures for users managing their payment methods.

- Biometric Authentication: Features such as facial recognition and fingerprint scanning are becoming standard practice, enabling users to authenticate payments swiftly and securely.

- Digital Wallets: The rise of digital wallets, such as Apple Pay and Google Wallet, simplifies the process of saving and managing credit cards, allowing for seamless transactions and enhanced user experience.

Trends in Mobile Payment Security and Privacy

In tandem with technological advancements, security and privacy in mobile payment methods continue to evolve. Notable trends include:

- End-to-End Encryption: This technology ensures that payment information is encrypted from the point of sale to the payment processor, significantly reducing the risk of data breaches.

- Dynamic Authentication: Implementing methods such as one-time passwords (OTPs) adds an additional layer of security, making it harder for unauthorized users to access sensitive information.

- Privacy Regulations Compliance: Companies must adhere to strict privacy regulations, such as GDPR and CCPA, ensuring that users’ personal and financial data are handled responsibly and transparently.

Shifts in User Behavior Regarding Mobile Payments

User behavior regarding mobile payments is experiencing significant shifts, influenced by convenience, security, and evolving consumer preferences. Important insights include:

- Increased Adoption of Contactless Payments: Consumers are increasingly favoring contactless payment options, driven by the demand for quicker and hygienic transaction methods.

- Preference for Mobile Apps: With the convenience of managing financial transactions from a single app, users are opting for mobile applications that consolidate various payment methods.

- Demand for Personalization: Users seek personalized financial experiences, prompting companies to leverage data analytics to tailor services and notifications to individual spending habits.

As technology continues to evolve, the future of mobile payment methods will be defined by enhanced security, seamless integration, and a user-centric approach that places convenience at the forefront.

Final Thoughts

In conclusion, mastering the art of Saved Credit Cards iPhone View Delete Order Payment Method Management equips you with the tools needed for a hassle-free payment experience. By understanding the functionalities and security measures involved, you can enjoy quicker transactions while keeping your financial information secure. Stay ahead of the curve in mobile payments and elevate your shopping journey today!

Clarifying Questions

How can I access my saved credit cards on iPhone?

You can view your saved credit cards through the Wallet app or by checking settings in Safari for saved payment information.

What should I do if I can’t view my saved cards?

If you encounter issues, try restarting your device, ensuring your iOS is up to date, or checking your Apple ID settings.

How do I delete a saved credit card from my iPhone?

To delete a card, open the Wallet app, select the card you wish to remove, and tap on the ‘i’ icon to find the delete option.

What are best practices for managing payment methods on my iPhone?

Regularly review your saved cards, delete old or unused cards, and set strong passcodes or biometric authentication for added security.

Are there security apps recommended for protecting saved credit card information?

Yes, applications like LastPass and 1Password offer strong password management features that can help enhance security.

Leave a Comment